Recent News

2025-01-13

Hong Kong Property Market Forecast for 2025 More

2024-01-24

Hong Kong Property Market Forecasts for 2024 More

2023-03-02

[P Mortgages] What is a P mortgage? And is it the best choice for buying a property? Should I choose P, H, or fixed-rate mortgages when buying a property? More

2022-01-26

OneDay Vietnam Officially Launched More

2021-11-15

Vietnam Land For Sale | Rare Seafront plot in Da Nang 40+ Acres More

2020-11-03

Estate Agent App 2.0 Launched More

2020-09-05

Eligibility for SME Financing Guarantee Program More

2020-08-25

Mortgage guarantor More

2020-07-30

Android Version of OneDay (搵地) Agent App Launched More

2020-07-15

Hong Kong Stamp Duty: Your Complete Guide 2020 More

Hong Kong Stamp Duty: Your Complete Guide 2020

2020-07-15 | Author:

Note: This Oneday.com.hk stamp duty article serves as a guide to paying stamp duty in Hong Kong. In case of doubt, please refer to the relevant Hong Kong IRD regulations or seek advice from legal professionals. Additionally, this OneDay.com.hk blog article will focus on stamp duty in relation to the sale, transfer, and or lease transactions of Hong Kong property.

Hong Kong Stamp Duty Calculator

To calculate Hong Kong stamp duty payable, please visit the Hong Kong stamp duty calculator page on the Oneday.com.hk blog.

Introduction to Hong Kong Stamp Duty

In an effort to dampen the escalating property prices across residential, commercial and industrial property in Hong Kong, the Hong Kong Government has made a number of changes to the Hong Kong Stamp Duty Ordinance.

These changes include legislation for a new Special Stamp Duty (SSD) to deter house flipping, as well as new, higher Ad Valorem (AVD) rates for non-Hong Kong permanent residents and/or multiple property owners (Buyer’s Stamp Duty or BSD), and for the first time, new AVD rates rates for non-residential property transactions as well.

The recent changes to the Hong Kong Stamp Duty Rates reflect higher rates, which will no doubt have some influence on Hong Kong’s notoriously expensive property market.

What is Stamp Duty?

In basic terms, stamp duty is a duty (also known as a tax) imposed by the Hong Kong Government on the legal recognition of certain documents and paid to the government. In other words, when someone buys, sells, or transfers real estate (e.g. a house or a building) in Hong Kong, stamp duty (tax) must be paid to the government.

History of Hong Kong Stamp Duty

Stamp duty in Hong Kong has been around for a long time. It was introduced in Hong Kong in 1866 by the British Hong Kong colonial government on all written legal documents. Stamp duty remained throughout Britain’s rule of Hong Kong and it was even retained by the Hong Kong Special Administrative Region (SAR) after the 1997 transfer of sovereignty over Hong Kong from Britain back to Mainland China.

Why Is Stamp Duty Important?

Stamp duty was originally introduced to cover the administrative cost of the written legal documents (sometimes called ‘written instruments’) that are incurred when processing a property transaction. For example, written legal documents could include an ownership title of a property, or a document highlighting a database search to ensure someone is buying the correct property from the right person).

However, the purpose of stamp duty has evolved over time and, nowadays, stamp duty is a tool that can be used to achieve a number of social and economic outcomes, including the following:

- Helps deter speculative property investment: Speculative property investment or ‘house flipping’ can lead to an overheated and rapidly escalating property market where investors buy and sell a property in a short amount of time in order to make a quick profit. Imposing stamp duty on ‘house flippers’ discourages this activity meaning that the property market rises in a more manageable rate.

- Helps cool a rising property market: When buyers and sellers are required to pay stamp duty each time a property is bought, sold or transferred (often for higher amounts each time), these buyers and sellers may reconsider their intentions and hold onto they currently property for longer. It has been argued that when stamp duty is used as intended in this way, it can slow down household mobility, preventing people from moving house due to the extra costs so that the property market can rise at a slower and more manageable way and make home ownership more achievable for more people.

- Support first home buyers looking to get on the property ladder: When a property market rises at a slower and more manageable rate, home ownership is more likely to be achievable for more people, especially for first time home owners desperately trying to get onto the property ladder. In Hong Kong, first time home buyers who are also Hong Kong permanent residents are eligible to pay significantly cheaper stamp duty rates.

- Helps improve social equity: When home ownership is not restricted to only the super wealthy, it can help reduce the gap between the rich and the poor. One way to make home ownership achievable for more people is to offer cheaper stamp duty rates for first time home buyers who are also Hong Kong Permanent Residents.

- Helps raise revenue for the Government: Stamp duty helps raise much needed revenue for the Government which can be used to drive economic development for the city for all.

Despite the fact that stamp duty can drastically alter the cost of buying a property, overall, there seems to be a reasonable level of public acceptance for stamp duty on property in Hong Kong. This is especially so for Hong Kong Permanent Residents looking to get on the property ladder with their first residential property because this category of property purchasers are eligible to pay significantly lower stamp duty rates calculated at the original, lower scale (see AVD Scale 2). However, the recent introduction of stamp duty rates for non-residential in 2016 has some businesses concerned.

Regardless, given the notoriously high demand for all types of property in Hong Kong, coupled with the consistent shortage of land provisioned by the Hong Kong Government for the development of new property, it remains to be seen whether and how this new measure could effectively contain the heat in Hong Kong’s red hot property market in the long-run.

When Does Stamp Duty Apply?

In Hong Kong, there are several situations when stamp duty must be paid. Below are the main examples of where stamp duty can be applied:

- When someone buys or sells a house or building (i.e. Agreement for sale and purchase of immovable property)

- When someone assigns or transfers a property title (i.e. Conveyance on sale)

- When someone leases a house or building to another person or company (i.e. Tenancy Agreement)

- When someone buys, sells or transfers stocks and bonds

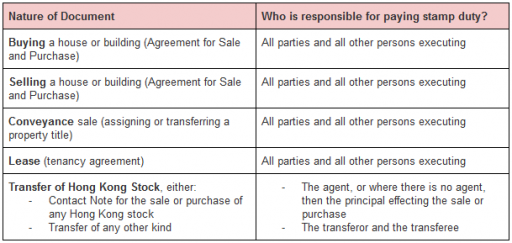

Who Is Responsible For Paying Stamp Duty?

Generally, the individual (or company) responsible for paying stamp duty depends on whether the individual or company is buying, selling, or conveyancing a property in Hong Kong.

- Buying/acquiring property: When an individual or company is buying or acquiring a property, typically the buyer is responsible for the payment of stamp duty.

- Selling/conveyancing property: When an individual or company is selling or conveyancing a property within a short time frame (up to 36 months of acquisition), typically the seller is responsible for the payment of stamp duty.

However, the Hong Kong IRD website clearly states that the buyer and the seller (and any person who uses the instrument) will be jointly and severally liable to pay AVD Stamp Duty, be it calculated at Scale 1 or Scale 2 rates. In other words, the buyer and seller and any person who uses the instrument will have the same extent of liability, under the law, to pay for any AVD payable on the chargeable instruments, irrespective of any agreement to the contrary made between them. See table 1 below.

If you are considering buying or selling property in Hong Kong, always seek legal and tax advice on your liability for paying stamp duty before entering into any Provisional Agreement for Sale and Purchase.

Table 1: Parties Responsible For Paying Stamp Duty When Buying, Selling, Or Leasing Property

Individuals or companies who are liable to pay stamp duty will vary according to the nature of documents as follows:

What Are The Main Types Of Property Stamp Duty In Hong Kong?

There are four main types of stamp duty. Under certain scenarios it may be possible that a buyer or seller has to pay multiple stamp duties: Below are the four main types:

-

New Ad Valorem Stamp Duty (AVD) - Table 2

-

Buyer Stamp Duty (BSD) - Table 2

-

Special Stamp Duty (SSD) - Table 3

-

Stamp Duty For Leases - Table 4

What’s The Difference Between the New AVD Stamp Duty And The Original AVD Stamp Duty?

Features Of The 'New' AVD Stamp Duty (Scale 1)

- The New AVD Stamp Duty Scale (known as Scale 1) came into effect on 5 November 2016. It is split into two parts:

- Part 1 of Scale 1: Applies to residential property (also known as Buyer’s Stamp Duty)

- Part 2 of Scale 1: New AVD rates which apply to non-residential property

- All the rates under the New AVD Stamp Duty Scale (Scale 1) are higher compared to the original AVD Stamp Duty Scale (Scale 2)

- For non-residential property: The new AVD Stamp duty scale incorporates non-residential property for the first time

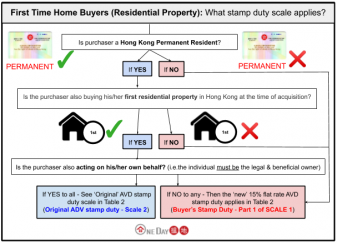

- For residential property: Some residential buyers may be eligible to pay the lower rates under the Original AVD Stamp scale (Scale 2). See Diagram 1 below

- For more information, see Diagram 1 and Table 2 below

Features Of The New AVD Stamp Duty Scale (Part 1 of Scale 1):

- If a prospective buyer is not a Hong Kong Permanent Residents, or they already own one or more residential properties, they will have to pay a flat fee stamp duty of 15%, irrespective of the value of the property (part 1 of scale 1)

- The flat rate of 15% will apply to all residential purchases, irrespective of whether the purchaser is an individual, company or otherwise.

- The flat rate will apply to all agreements for sale and purchase executed on or after 5 November 2016, unless specifically exempted or provided otherwise in the Stamp Duty Ordinance.

- The AVD must be paid within 30 days after the execution date.

- For more information, see Diagram 1 and Table 2 below

Features Of The New AVD Stamp Duty Scale (Part 2 of Scale 1):

- With effect from 5 November 2016, AVD at Part 2 of Scale 1 applies to instruments of non-residential property (i.e. commercial, industrial, retail etc.)

- The AVD must be paid within 30 days after the execution date.

- For more information, see Table 2 below

The 'Original' AVD Stamp Duty Scale (Scale 2)

- The Original AVD Stamp Duty Scale is known as ‘Scale 2’ and applies to residential property

- To qualify for these cheaper residential stamp duty rates recognised under the Original AVD Stamp Duty scale, the purchaser must be:

- A first time home buyer of residential property AND;

- A permanent Hong Kong residents

- If a Hong Kong Permanent Resident buyer changes/switches or upgrades his/her single residential property within 12 months from the date of completing the new transaction, then he/she could be eligible for a refund of the extra duty (i.e the difference between Scale 2 Stamp Duty Rates and Part 1 of Scale 1 Stamp Duty Rates).

- For more information, See Diagram 1 and Table 2 below

Hong Kong Stamp Duty Diagram for Residential Buyers - What Stamp Duty Scale Applies?

Diagram 1: How To Determine What Stamp Duty Rates Scale Applies If You Are A Residential Property Buyer

The below diagram (Diagram 1) and table (Table 2) outlines the eligibility of Hong Kong Permanent Residents and First Home Buyers to pay lower stamp duty rates under the original AVD scale (Scale 2) or the new, higher, AVD scale (Scale 1) - see Table 2 below

Hong Kong Stamp Duty Rates Table for Residential and Non-Residential Property

The below table outlines the different Hong Kong stamp duty rates for residential and non-residential property, effective since 5/11/2016

Hong Kong Ad Valorem Stamp Duty Table

| Property value (HKD) | Scale 2 AVD | Scale 1 AVD - effective 5/11/2016 | |

|---|---|---|---|

| Original AVD Stamp Duty | Part 1 of Scale 1 (Buyers Stamp Duty*) | Part 2 of Scale 1 (Non-residential) |

|

| $0 - $2,000,000 | 100 | 15% | 1.5% |

| $2,000,001 - $2,176,470 | $100+10% of excess over $2,000,000 | 15% | $30,000+20% of excess over $2,000,000 |

| $2,176,471 - $3,000,000 | 1.5% | 15% | 3% |

| $3,000,001 - $3,290,330 | $45,000 + 10% of excess over $3,000,000 | 15% | $90,000 + 20% of excess over $3,000,000 |

| $3,290,331 - $4,000,000 | 2.25% | 15% | 4.5% |

| $4,000,001 - $4,428,580 | $90,000+10% of excess over $4,000,000 | 15% | $180,000+20% of excess over $4,000,000 |

| $4,428,581 - $6,000,000 | 3% | 15% | 6% |

| $6,000,001 - $6,720,000 | $180,000+10% of excess over $6,000,000 | 15% | $360,000+20% of excess over $6,000,000 |

| $6,720,001 - $20,000,000 | 3.75% | 15% | 7.5% |

| $20,000,001 - $21,739,130 | $750,000+10% of excess over $20,000,000 | 15% | $1,500,000+20% of excess over $20,000,000 |

| $21,739,131 - | 4.25% | 15% | 8.5% |

*Unless specifically exempted, Buyer’s Stamp Duty (BSD) is payable on an agreement for sale, or a conveyance on sale, for the acquisition of any residential property executed on or after 27 October 2012, except where the purchaser, or the transferee, is a Hong Kong permanent resident (HKPR) acquiring the property on his/her own behalf (i.e. the person is both the legal and beneficial owner).

What is Hong Kong Special Stamp Duty (SSD)?

Special Stamp Duty (SSD) is a duty paid by sellers of Hong Kong residential property. Special Stamp Duty was enacted by the Legislative Council on 27 February 2014 and took effect retrospectively from 27 October 2012 in an effort to minimise speculative property investing where buyers purchase residential property with the intention of reselling within a short time period for a profit. This type of speculative property investment is sometimes referred to as ‘house flipping’.

In a rising property market, house flipping can lead to escalating house prices where a property sells for higher and higher amounts each time and to the point where only the wealthy can afford to buy or invest in property. In this situation, imposing a stamp duty can slow down household mobility, preventing people from moving house due to the extra costs so that the property market can rise at a slower and more manageable way and make home ownership more achievable for more people.

Special Stamp Duty (SSD) must be paid whenever an individual or company acquires a property and then resells it within a short time period (see Table 3 below for rates). Imposing stamp duty on ‘house flippers’ discourages house flipping activity meaning that the property market rises at a more manageable rate.

Key Features Of Special Stamp Duty (SSD)

- The aim of Special Stamp Duty (SSD) is to try to prevent ‘house flipping’

- Any residential properties resold within specific ‘holding periods’ will be charged stamp duty (see Table 3 below for rates)

- Special Stamp Duty (SSD) is paid by the vendor/seller at different rates when the property is resold within a 36 month period (see rates below)

- Special Stamp Duty (SSD) is only applicable for residential properties acquired on or after 27 October 2012; therefore a property acquired before 27 October 2012 will not have to pay Special Stamp Duty (SSD)

- Unless otherwise specified in the Provisional Agreement for Sale and Purchase (PASP) and the Agreement for Sale and Purchase (ASP), the seller, rather than the buyer, normally pays the Special Stamp Duty (SSD)

- The Special Stamp Duty (SSD) must be paid within 30 days after the execution date.

Under What Circumstances Does Special Stamp Duty (SSD) Have To Be Paid?

Unless otherwise exempt, Special Stamp Duty (SSD) is payable whenever a property is bought and then resold within a 36 month period. Property owners who buy and hold their property long-term (i.e. more than 36 months) won’t be affected by Special Stamp Duty (SSD).

Who Pays For Special Stamp Duty (SSD)?

Unless otherwise exempted, the seller and the buyer should, by consent, specify in the Provisional Agreement for Sale and Purchase (PASP) and the Agreement for Sale and Purchase (ASP) which party (the buyer or the seller) shall pay the Special Stamp Duty (SSD). If it is agreed that the Special Stamp Duty (SSD) should be paid by the seller, we suggest the buyer specify in the PASP and ASP that he will withhold part of the sale proceeds to pay for the Special Stamp Duty (SSD).

Table 3: Special Stamp Duty (SSD) Rates In Hong Kong

To calculate the correct Special Stamp (SSD) Duty rate, use the table below. The Special Stamp Duty (SSD) rate payable depends on the holding period of the property and is calculated by reference to the stated consideration or the market value of the property (whichever is higher):

What is Buyer’s Stamp Duty or BSD?

Buyer’s Stamp Duty (BSD) is an additional tax on non-permanent-resident individual buyers and non-permanent company buyers. The buyer’s stamp duty has to be paid upfront.

- Buyer’s Stamp Duty (BSD) only applies to non-permanent resident buyers and non-permanent company buyers

- Buyer’s Stamp Duty (BSD) will apply if the ‘Buyer’ is a Company (i.e. if the individual buying the property is not acting on his/her own behalf and won't be the legal and beneficial owner)

- Buyer’s Stamp Duty (BSD) was enacted by the Legislative Council on 27 February 2014 and took effect retrospectively from 27 October 2012, so Buyer’s Stamp Duty (BSD) only applies to property purchased on or after 27 October 2012.

How Much Is Hong Kong Buyer’s Stamp Duty (BSD)?

Unless specifically exempted, Buyer’s Stamp Duty (BSD) is charged at 15% on the stated consideration or the market value of the property (whichever is higher). See Table 2 (Part 1 of Scale 1).

Who Is Responsible For Paying Hong Kong Buyer’s Stamp Duty (BSD)?

Unless otherwise exempted, the buyer or the transferee (i.e. anyone receiving a property from another person) is responsible for paying the Buyer’s Stamp Duty (BSD)

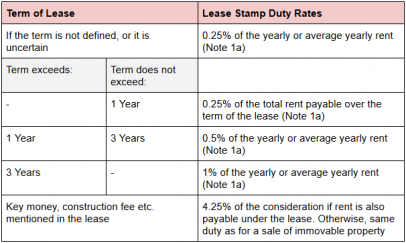

What Is The Stamp Duty Payable For Leases?

Table 4: Hong Kong Stamp Duty Rates For Leases

For the lease of immovable property in Hong Kong, stamp duty is calculated at rates which vary with the term of the lease as follows:

Note 1a: The yearly rent, average yearly rent, or total rent has to be rounded up to the nearest $100. Any deposit which may be mentioned in the lease will not be taken into account in assessing the stamp duty.

What Is Double Stamp Duty?

Since the introduction of the new AVD Stamp Duty in November 2016, the stamp duty rates have increased.

The new rates of stamp duty on the purchase of both residential and non-residential properties are a significant leap from the original stamp duty rates, in fact, they are nearly double the original rate, which is why they are often described as ‘Double Stamp Duty’ (Scale 1 of the new AVD).

Under the new regime, where purchases by non-Hong Kong permanent residents and/or if the purchaser already owns another residential property at the time of the subsequent purchase, the purchaser will have to pay approximately double the normal stamp duty up to a ceiling of 8.5% on Hong Kong properties valued at HKD $2 million or more.

Who is Exempt From Paying Stamp Duty?

Just about every party involved in the sale, purchase, or conveyance (i.e. transfer or assignment) of immovable property in Hong Kong is expected to pay some form of stamp duty. However under certain conditions, some parties could be eligible to pay lower rates of stamp duty, or even no stamp duty at all, depending on the situation. The availability of stamp duty exemption or relief may depend on who is involved, the type of arrangement or the type of Hong Kong property involved.

General exemptions of Hong Kong stamp duty:

General exemptions and relief from stamp duty includes:

- any instruments duly stamped under the stamp regulations enforced by the Japanese in Hong Kong during the Second World War;

- all conveyances on sale, and agreements for sale of residential property, to the Government or an incorporated public officer;

- all grants by the Government and all Government leases and all surrenders of such grants and leases;

- all instruments executed by the Housing Authority for the purposes of the Housing Ordinance other than a conveyance on sale by which the Housing Authority exercises its statutory power to dispose of land upon terms to any person;

- any agreement for sale to which the Housing Authority or person nominated by the Housing Authority is a party, or which is made with the consent of the Housing Authority;

- all conveyances on sale, and agreements for sale of exempted premises to an exempted person; and

- any instrument relating solely to the property of any bankrupt or company being wound up by the court or under a creditors’ voluntary winding up.

For more information or to check if you are eligible for stamp duty exemption, please refer to the Hong Kong SAR Inland Revenue Department and seek professional legal and or tax advice on your liability for paying stamp duty before entering into any Provisional Agreement for Sale and Purchase.